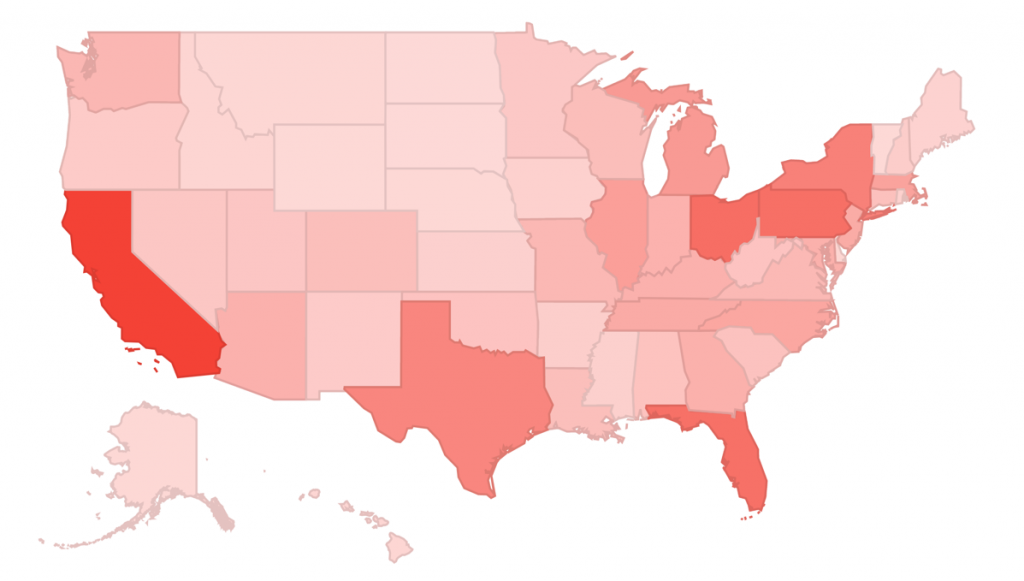

When was the last time you set foot in a bank? If you’re like most Americans, you’ve completed many transactions since you actually stepped up to those marble countertops or used one of those pens they have attached to a chain. With the convenience of online and mobile banking for making payments, transferring funds or monitoring account balances, consumers more often than not are going digital for all of their banking needs. According to a recent Harris Interactive survey commissioned by Tealeaf, more than two-thirds of online adults in the U.S. regularly use online banking to conduct financial transactions, and nearly 60 percent have used mobile banking offerings.

Despite its rise in popularity, mobile commerce isn’t always as smooth as it could be. In fact, 84 percent of mobile customers say they have experienced struggles that prevented them from completing their transactions. These negative experiences are not only frustrating, but time-wasting for busy consumers.

In the banking industry, access to online and mobile banking is high on the list of customer demands, especially among Millennials—the largest American generation since Baby Boomers. So it’s more important than ever for banks to invest in technology to ensure that the online customer experience they provide is on par with the personalized service delivered in-branch.

Here are a few suggestions on how to go about achieving this goal:

- Prioritize: Banks must make online and mobile customer experience a priority. Customers expect to complete transactions flawlessly, so banks need to quickly detect and resolve any site issues that prevent customers from successfully interacting with the site. To be clear, these issues are often much harder to detect than simple 404 errors—they are often usability issues that can go undetected by traditional web analytics or application performance monitoring tools.

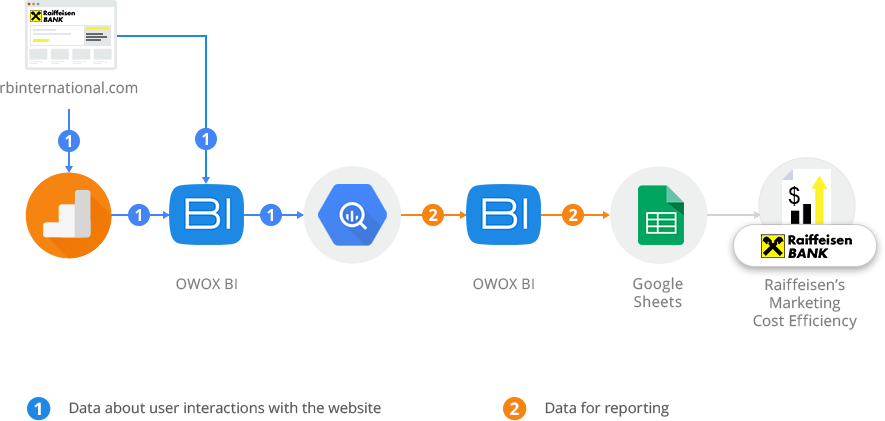

- Monitor: Banks must truly understand how consumers interact with their sites to provide them with the best experience possible. Investing in customer experience management tools enables companies to gain real-time visibility into how users behave on their sites. This insight goes beyond traditional feedback forms and analytics, allowing banks to delve deeper into their customers’ online experiences.

- Interact: To succeed, it’s important for banks to establish a social media presence and monitor any comments, tweets or posts that mention their brand. Consumers increasingly use social media, where they are quite vocal when they have positive and — more importantly—negative experiences with a company. It’s critical for financial services firms to make every effort to prevent the poor online experiences that lead to viral rants impacting their brands.

- Cross Channels: No matter how sophisticated a company’s website is, it’s inevitable that some interactions will spill over into the contact center. However, most contact center agents have no idea what the caller saw or did online or where things might have gone wrong. This lack of visibility creates a multi-channel customer experience gap that results in slower problem resolution, lower first-call resolution rates, lower customer conversion rates and ultimately less satisfied customers. To close this gap, call center teams need visibility into the online experience of each customer.

By implementing a customer experience strategy, banks can correct website glitches that would otherwise damage customer satisfaction and impact the company’s bottom line. Improving customer experience allows banks to refine their web presence and stay competitive in an extremely saturated market. By providing a virtually flawless experience to its customers, financial services firms can give themselves a competitive edge. Most of the best financial services firms are already managing customer experience. In fact, eight of the top 10 U.S. banks are using Tealeaf to do so.

As demand for access to online banking continues to grow and more customers rely on smartphones for managing their finances, banks and other financial service companies would do well to ensure that these transactions are easy to perform and that the cross-channel (mobile, web, call center) customer experience is as seamless as possible.