We have all heard many times that reporting data has nothing to do with being a data driven organisation, yet most digital analysts complain that all they basically do is report data.

One of the reasons why digital analytics is often seen as merely reporting is that it often does not speak the language of the business. If we make an effort to incorporate business metrics and concepts in our analysis, we will have a greater chance to influence decision making.

In this post, I will discuss COGS (Cost Of Goods Sold) and LTV (Lifetime Value), two fundamental business metrics that can help web analysts be more meaningful and influential with their analysis.

COGS – Cost Of Goods Sold

COGS is the cost of the goods we sell. If we understand cost, we can make a distinction between revenue (total sales) and gross margin (total sales – cost of products sold). These metrics are essential not only to have a more accurate idea of net income, but to understand how well a business can grow and scale.

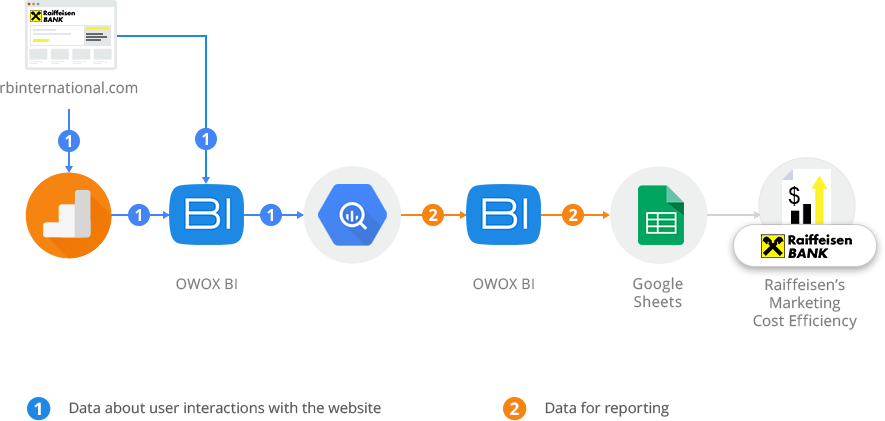

The following screenshot shows a typical Google Adwords performance report.

The report measures business performance based on revenue. We are told that for every Adwords click, we have a revenue of 4€ on average. Since an Adwords click is costing us around 2€ on average, that looks like a pretty good revenue. The report uses ROAS as a measure of how “profitable” the campaign is. (Tip: you can add COGS to Google Analytics using product data import).

But is ROAS a good measure of business performance? Well, it depends. Depending on cost, we could be actually losing money with the Adwords campaign, no matter how good ROAS looks. Hence, this report needs to take into account COGS if the analysts wants to fully understand whether the campaign is good for the business or not.

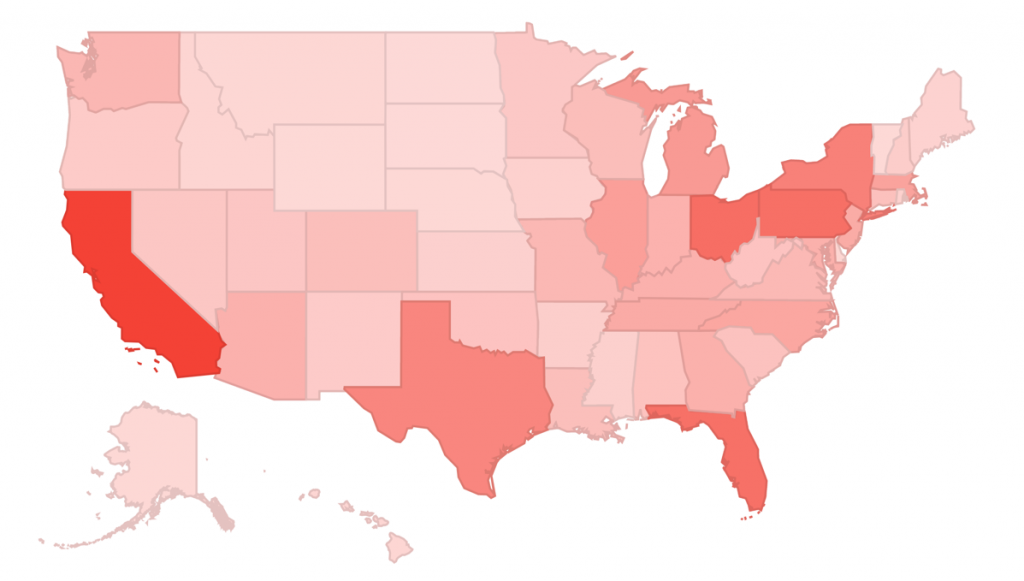

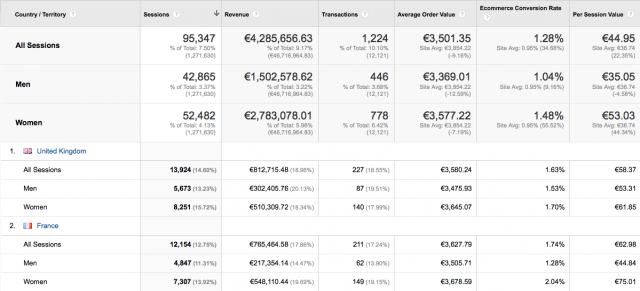

COGS is also very useful for e-commerce analysis. Take a look at the following report:

Usually, product performance is judged on the basis of conversion rate, session value and / or average order value. For instance, according to the report, conversion rate for the “Women” product category in France is so good that we’re tempted to throw lots of money into campaigns to promote it. That could be a good decision, or a bad decision. It depends on the margin that we have for that category in that particular country. Perhaps conversion rate for “Men” is much lower, but gross margin per sale is way higher, and hence we can spend much more on advertising to get to the same amount of sales.

In summary, if you want your analysis to be influential, revenue is not enough. First, because you do not know if you’re actually optimising for what makes sense for the business (revenue? net income? gross margin? scale?) Second, because you’re missing part of the language that senior managers use. They might not know anything about CPC, RPC or ROAS, but they like to discuss revenue, net income, gross margins and scale, and for good reasons. Use that to your advantage.

LTV – Customer Lifetime Value

Customer Lifetime Value (LTV) is a metric that predicts the profit of an entire relationship with a client. Instead of focusing on the profit for the first sale, we try to estimate the profit for all sales we will make to that customer. Hence, we focus the company on long term relationships rather than short term profits, in other words, we incentivise innovation, better products and better customer service. Not bad for a single metric 🙂

In the previous example, I suggested that a positive ROAS doesn’t necessarily mean a profitable campaign. But even a campaign that is not profitable for the first sale could be very profitable in the long run. Many businesses depend on repeat purchases / renewals to be profitable. Hence, if we just optimise our campaigns based on first sale profit, we’re optimising for the wrong metric, with potentially disastrous strategic consequences.

This is also very important to take into account when we deal with attribution problems. In my opinion, just as important as accounting for multi-click / multi-device / multi-channel effects, a good attribution strategy should take into account LTV. You can be very good at building a sophisticated attribution model, but if you attribute for first sale, and your business only makes money after a repeat purchase, your models are useless.

It’s surprising how often this is overlooked, and we’re fascinated by statistically impressive models that are modeling (and hence optimising) for the wrong business behaviour.

Is Digital Analytics useless?

In this article, I have explained a couple of business metrics that can enrich your digital analysis and take it to another level. Am I saying that digital analytics is useless? Not at all, but like any other analysis, if you miss important variables to model the problem, your analysis will be probably useless.

Many of the digital analysts I meet rarely go out of their digital analytics packages to look for data. This is a dangerous thing to do, because it produces analysis that are not very useful, and in the long run devaluate the business value of digital analytics. Instead, digital analysts should be sitting with senior managers to understand the business KPIs that drive the company forward, and then adapt their tools and analysis accordingly.

There are many articles discussing how to use a free tool like Google Analytics to collect all sorts of data, including CRM and financial data. You can also use tools like Tableau, or even Excel, to analyse different data sources at the same time. I am not saying that this is an easy thing to do, but after all it’s a technical problem, and we have the tools to solve it.

What’s your experience as a digital analyst? Do you include concepts such as cost and lifetime value in your analysis? Should the digital analyst be doing this kind of analysis? What other business data should we use if we want our analysis to be more meaningful?